This article is the final installment in a three-part series on estate planning. In part one, we touched on the basics of estate planning – why we all need to put an estate plan in place. We also discussed the attributes of the will and the trust, the two most foundational documents in an estate plan. In part two, we walked through the history of estate and gift taxes from antiquity to present day. Taxes due at death were often used to raise revenue to pay down debt from one-time expenses like wars, but over time they became more ingrained in the tax code. Simply put, governments recognized the inevitable death of each of its citizens as a regular and predictable opportunity to tax the transfer of property from the decedent to his or her beneficiaries.

American/US Airways 401k Plans merge

The merger integration process takes another big step! We are confident that all the US Airways pilots were excited to learn that the new 401k for the company will be Fidelity, instead of the US plans moving to EMPOWER (formerly J.P. Morgan Retirement Plan Services). Legacy US pilots are now accessing their plan accounts at netbenefits.com/aa;

Ten Ways to Manage Stress

Stress is a reality of modern life. We are increasingly overworked and overtired. From caring for aging parents to finding quality childcare, from mortgage payments to escalating gas prices, the sources of stress for adults today are innumerable. While there is no way to completely eliminate stress from our lives, there are ways of minimizing

Update on the Intended Offer by FedEx for TNT Express

- May 13, 2015 Reference is made to the joint press releases by FedEx Corp. (NYSE:FDX) (FedEx) and TNT Express N.V. (TNT Express) dated 7 April 2015 and 1 May 2015 in respect of the intended recommended public cash offer for all issued and outstanding ordinary shares in the capital of TNT Express at an

ESTATE PLANNING—Part 2 TAXES

Last month’s Captain’s Table piece, was the first installment in a three-part series on estate planning. Estate planning is the “most overlooked, misunderstood and procrastinated piece” of the financial plan for most families, when it really shouldn’t be. Putting together a good estate plan is relatively straight-forward, especially with the help of an experienced attorney, and is not as costly, complex or time-consuming as you might think.

In Part one, we discussed the will and the trust. We discussed why the will is the foundation of any estate plan and how a trust can be a flexible, efficient and an inexpensive tool that complements the will, and can also helps keep matters private and outside of the public record. In this installment, we’ll focus on the history of the estate and gift tax system and how present laws impact bequests made while living and at death.

April 2015 Recap

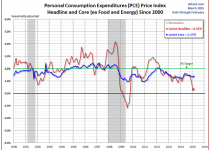

March Madness is in full swing with over 60 games having already been played.People all over the world fill out their brackets in hopes that they can predict the future, including the surprise upsets that turn an “also ran” bracket into a money winner. Those who filled out their brackets by working from the Championship game backwards and opting for favorites like Kentucky, Wisconsin, Duke, and Villanova are feeling rather confident right now. In the world of finance, investors are attempting to do the same thing when it comes to the Federal Reserve Bank’s interest policy. The favorites in this game are the consensus opinions regarding when and how the Fed Funds Rate is going to increase, and that has been June and is now starting to get pushed back to September. Instead of analyzing coaches, rosters and game stats, investors are studying Fed statements, inflation data, dollar strength, unemployment figures and economic measures such as GDP.

American Airlines Group a step closer to full US Airways integration

American Airlines Group (AAL +3%) lands approval from the FAA to legally operate US Airways under the American certificate. The development is an important step in fully realizing the benefits of integrating US Airways. It will take until the end of the year to merge the US Airways website with AA.com and more than a

FedEx to buy TNT for $4.8 billion to take on rivals in Europe

http://www.reuters.com/article/2015/04/07/us-tnt-express-m-a-fedex-idUSKBN0MY06G20150407 FedEx Corp (FDX.N) is to buy Dutch package delivery firm TNT Express (TNTE.AS) for an agreed 4.4 billion euros ($4.8 billion), stepping up the challenge to rivals United Parcel Service (UPS.N) and Deutsche Post (DPWGn.DE) in Europe. European regulators blocked a 2013 takeover of TNT by UPS due to concerns it would stifle competition,

March 2015 Recap

March Madness is in full swing with over 60 games having already been played.People all over the world fill out their brackets in hopes that they can predict the future, including the surprise upsets that turn an “also ran” bracket into a money winner. Those who filled out their brackets by working from the Championship game backwards and opting for favorites like Kentucky, Wisconsin, Duke, and Villanova are feeling rather confident right now. In the world of finance, investors are attempting to do the same thing when it comes to the Federal Reserve Bank’s interest policy. The favorites in this game are the consensus opinions regarding when and how the Fed Funds Rate is going to increase, and that has been June and is now starting to get pushed back to September. Instead of analyzing coaches, rosters and game stats, investors are studying Fed statements, inflation data, dollar strength, unemployment figures and economic measures such as GDP.

May 2015 Recap

There’s an antiquated stock market adage to “sell in May and go away”. The advice is really the back-end of an old two-step trading idea sometimes dubbed the “Halloween Indicator”. The idea is that the market performs best from November through April (inclusively), and that it’s a good idea to get out of stocks in May and sit in cash through the summer and well into the fall. While studies have shown that this very simple trading maxim actually has some statistical merit, the question a lot of folks have is: when do you sell in May - at the beginning or at the end of the month? Well, in 2015, it would have depended on whose stock market you were invested in. It would have been wise to stay invested in the U.S. stock market through the entire month, but if you had been invested in other stock markets around the world, then getting out at the beginning of May would have probably been best. The U.S. market, as measured by the S&P 500, fared better in May than it did in April, but world stock markets advanced less or were negative, and emerging market stocks posted negative returns for the month. Most U.S. and global bond indexes lost ground as well.