Market Overview

The back-to-office conspiracy

We’re not big into conspiracy theories, but we don’t dismiss them out of hand either. We don’t believe 9/11 was an inside job, for example, but we definitely believe Jeffrey Epstein knew too much.

The evidence supporting either of these claims doesn’t rise to any true standard of proof, but that doesn’t mean they’re wrong. Unless and until incontrovertible facts are uncovered, individuals will make up their own minds about how credible they are. And in that spirit, we present to you our own, home-baked conspiracy theory:

The back-to-the-office trend is fueled by something that has nothing to do with performance, efficiency, employee wellbeing, workplace morale or even the corporate bottom line. Another actor leads this drama from behind a mask.

Can we walk you through this?

The arguments pro and con

Two out of three employees who worked from home in the wake of the Covid-19 pandemic didn’t – and still don’t – want to return to work. Can you blame them? They found out they could function at their jobs without wasting time, money and mental energy commuting twice a day. Beyond that, you can work in the same clothes you wear to the gym and easily avoid anyone you don’t want to share space with. That you can save thousands of dollars a year on childcare or eldercare is just the icing on the cake (the figurative cake, not the literal one you’re expected to chip in five bucks because it’s the security guard’s birthday).

Of course, the shills from HR can counter that. People get lonely working from home and work can intrude on personal time and people can get marginalized in the decision-making process. Meanwhile, communication and collaboration opportunities are reduced.

A lot of this, of course, is nonsense. Some people do get lonely, but others just spend less time with their cubicle neighbors and more with their actual friends. HR doesn’t seem to mind if your boss requires you to stay late at the office, so it’s a laugh that they care about you getting a phone call during Wheel of Fortune. Decisions are made in conference rooms with the door closed and blinds drawn, not in the hallway to the printer room. And if in-person presence is so important for communication and collaboration, why does the company spend so much on WebEx, Slack and all that other remote working software? If showing up for meetings is so important, why do travel budgets always get slashed this time of year?

Up to now, employees have had the upper hand. From February 2022 through April 2024, unemployment was below 4%, effectively a labor shortage. Since then, it hasn’t gotten over 4.3% and is in fact trending down again. So as businesses demanded that workers return to their desks, their threats of pink slips have been met with two-week notices. As a result, the bosses’ requests to start coming into the office went largely unheeded. They then said that it was OK if you worked from home on a hybrid schedule, but you had to come in one, two, three or four days a week depending on the company. A lot of employees didn’t go for it, according to a Stanford University study, and experienced little in the way of repercussions. More than half of the policy violators either faced no consequences or received only a verbal reprimand.

No amount of get-to-know-you games, happy hours, bring-your-pet days, scavenger hunts or other return-to-work gimmicks – and there are dozens – will fix this. Even so, the pendulum is swinging back in the bosses’ direction, and the average American office worker is now remote only 1.7 days per week. At the moment, though, the hybrid model seems to be sticking, and five-days-per-week in the office remains a hard sell.

The great reveal

So why are companies so keen to keep their people on-premises?

“Efficiency!” is the thunderous reply from the corner office.

That is, to say the least, contestable. During the 2020-21 shutdown, a spate of research suggested that WFH could be more productive. That was followed by a spate that found the opposite to be true. A more nuanced academic study suggests that dull tasks are better performed at the office, but creative ones are better performed at home.

Considering how inefficient employees are in general, the difference is insignificant. Everyone pretends not to know this, but the average employee functions only three out of every eight hours.

So, no. If the return-to-office movement puts any money at all in the CEO’s pocket, it won’t be enough to notice. Who, then, benefits from return-to-office?

The people who own the office buildings.

Our conspiracy theory – and that’s all the credit we’re giving it – is this: The developers which own commercial real estate don’t want their business model to change, even if that means creating a demand for their service that the pandemic has already revealed to be overblown.

According to Moody’s, office vacancy rates hovered around 16% before the pandemic, which even then was considered higher than healthy for the commercial real estate market. Covid then drove it up to around 18.5%. Vacancy dipped toward the end of 2021 but has since surged to a cyclical high above 20%. That is, if you work in a 25-floor office building, five of them are probably in mothballs. One analyst reckons that the current excess space equals the entire square footage of the Atlanta office market.

Office space has been overbuilt for decades but, at the same time, the residential market is as tight as it has ever been. Literally millions of households need a new place to live. The answer seems simple, right? Refit the offices into apartments. In Dallas, for example, developer Jonas Woods is doing exactly that for Bryan Tower and Santander Tower. He’s not the only one in Dallas, certainly not the only one across the country.

But this hasn’t worked at scale for a couple of reasons. First of all, repurposing a 500-foot high skyscraper is a difficult design and construction challenge. You probably want more daylight shining into your apartment than into your cubicle, so the whole structure of the building has to be rejiggered. Living spaces have far different requirements for plumbing, electricity and mechanical systems than workspaces. This is all difficult, time-consuming, material-intensive, costly work.

But that’s actually the lesser reason. After all, the more we do such renovations, the more streamlined and thus less expensive the process becomes. And as we noted, there are literally millions of people willing to hand over the money today for a center-city apartment.

The more insidious reason is the layers of perverse, non-market incentives driving the commercial real estate racket. This started on the federal level in 1981.

“In a bid to boost the economy, the Reagan administration allowed investors to depreciate commercial real estate much more quickly than before, among other changes, lowering their tax bills,” according to the Wall Street Journal.

But the cities themselves greatly aggravate the situation by their own short-sighted tax policies. Some taxing districts provide abatements for unoccupied or underoccupied buildings, and these abatements might be more valuable than the rent the landlords could extract from new tenants. The owners of 7 Times Square in New York, for example, get $22.9 million per year in forbearance from the city for not renting space out, so why bother working hard to maybe break even? Better to wait until the market corrects and they can charge higher rates – even if that takes decades.

Connecting the dots

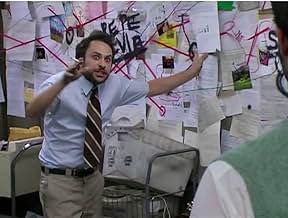

One string is still dangling off our conspiracy wall, though. What’s the connection between the landlord and the boss? As it turns out, that’ll take two strings.

The first one goes directly from one party to the other. Another Wall Street Journal article calls out the widespread practice of real estate firms charging above-market rates for rents, then kicking back cash to the lessees. This works out well for both sides.

“Landlords are showering tenants with tens of millions of dollars and months of free rent,” according to the Journal. “Paying money to inflate rents helps keep building prices high despite the rise of remote work, meaning landlords can expect to profit when they sell a building or take out a mortgage. That is because banks and investors calculate property values, in part, based on a building’s rents.”

The Journal goes on to say – and this dovetails nicely with our final point – that “[h]igh rents also create confidence in the broader property market, boosting publicly traded companies’ share prices and attracting investors.”

That second string is a long one and it goes clear around the board. The entire economy is interconnected. And in a market economy such as ours, that connection often comes via the institutional investors.

You know how we always tell you to diversify your portfolio – to make sure you hold stocks and bonds … and real estate? We didn’t think of that ourselves. That’s how BlackRock, Vanguard, State Street and the rest of the white-shoe firms roll. So, it’s not unlikely that the employer you work for and the group that manages the office you work in both report up to the same owners.

You can look it up yourself. The Securities & Exchange Commission requires all companies that sell securities to the public to publish a proxy statement, Form DEF 14A, at least once per year. Proxy statements list every entity that owns at least 5% of the company. Compare your company’s proxy statement with that of the company managing your office building.

Still, this has just been a thought exercise. Certainly, there must be other explanations as to why people are being ordered back to the office whether it makes sense or not. There has to be some degree of natural demand for office space, or it wouldn’t have existed for so many millennia.

Consider this nothing more than a conversation starter between you and your financial advisor.