Market Overview

One nation, indecipherable

You know how you can tell that, as of November 6, 2018, we’ve entered the Millennial age of American politics? There were no losers. Everybody got a trophy.

As of the following morning, there was still no firm count of exactly how many House of Representatives and Senate seats would be claimed by each party, but it was clear that the Democrats would claw back the majority in the lower chamber while the Republicans would pad their majority in the upper.

Democrats who expected a “blue wave” were disappointed. While eking out a majority, they flipped only about two-thirds as many House seats as they might have. Even so, they achieved their goal with some room to spare and they now hold the federal purse strings, since all funding bills originate in the House.

The Republicans are more than consoled by their success in Senate races. They were widely expected to improve their majority by a seat or two, but it looks like the First Tuesday of November treated them especially well this year. We’re still waiting for final results from such battlegrounds as Florida, where the seat is poised to shift from blue to red, and Arizona, a longstanding Republican redoubt that was liable to fall to a Democratic siege. GOP candidates are in the lead in these two races but, even if they lose all them both, they’d still lay claim to the same majority they have today. This means that President Trump will have little difficulty getting his cabinet, judicial and diplomatic appointees approved – and that, even if a Democratic House should impeach him, the Republican Senate is unlikely to convict and remove him.

The biggest surprises, though, were in the gubernatorial races. The Democrats really had no business winning in Kansas, and yet they did, while also picking up mansions in Illinois, Maine, Nevada and New Mexico. Wisconsin and Michigan – the states that put candidate Trump over the top two years ago – will also be redecorating their executive offices from red to blue. And yet the Republicans held onto the biggest prize, Florida.

It’s really tempting at this point to talk about what the 2018 midterms mean for the world, the president or the American soul, but all that is beyond our brief. It also bears mentioning – and celebrating – that more female candidates ran for and won election this month than ever before in our nation’s history. Still, let’s stay focused on what this means for your investment portfolio.

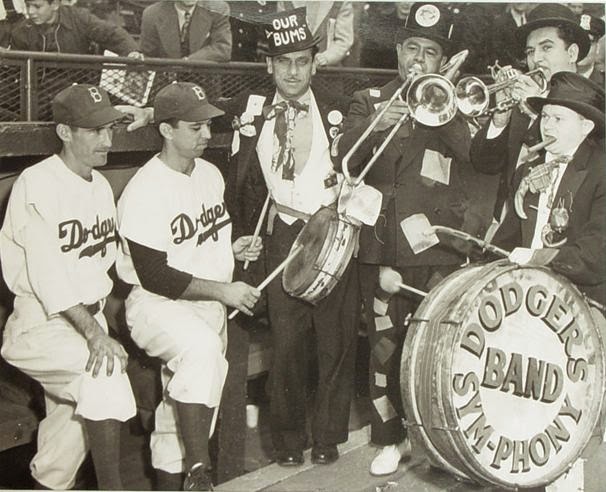

Uncle Sam stands for the government, but the personification of America has always been Columbia, shown here in a 1917 poster by Paul Stahr. Credit: National Archives

Looking forward

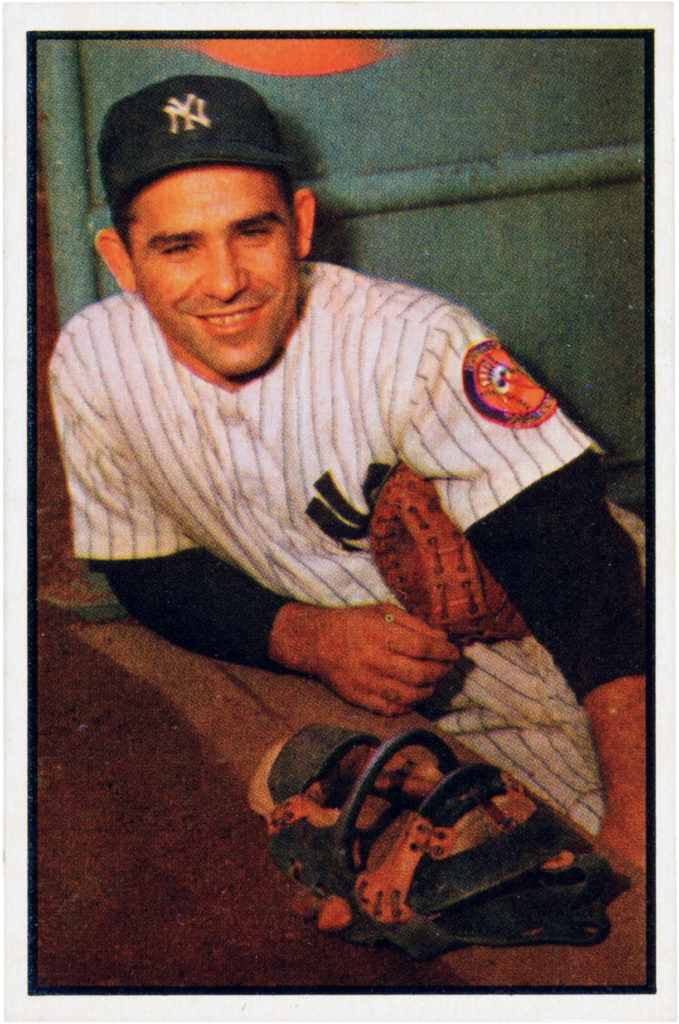

Need we say, with the 2016 election still fresh in our minds, that prognostication is a dangerous business? We’re reminded of the words of 20th century American philosopher Lawrence Peter Berra: “It's tough to make predictions, especially about the future.”

Whatever you have to say Yogi Berra, shown here in 1953, already said it better. Credit: Bowman Gum

Essentially, there are three questions that need to be addressed:

- How will the results affect different asset classes?

- How will the results affect different industrial sectors?

- To what extent were the results predictable and, thus, already valued by the market?

The conventional wisdom is that Democratic victories tend to favor bonds over stocks, but that’s not turning out to be the case. Equities surged in the wake of the 2018 midterms, while Treasury yields fell.

Even so, CNBC reports some bond traders believe that “a split Congress could stall plans for further tax cuts or major spending. That, in turn, could be a modest boon for bonds prices, which have come under pressure thanks to historic deficit spending and debt issuance from the Treasury Department.”

As for sector analysis, healthcare stocks were the immediate beneficiaries of the Democratic victory for control of the House, but there was little else in the way of industry-specific interest in the short run. As for the long run, we aren’t convinced of the wisdom of playing the sector game based on any election cycle’s political winds.

And, as we’ve already stated, the actual results varied from those predicted by polls only by degree and by the outcomes of individual races – the overarching net-net was directionally similar to what had been forecast for weeks. So both the stock and bond market have had ample time to factor these predictions into valuations of these financial assets.

Even so, equity markets cheered the November 6 results.

“’Gridlock is good’ is an oft-heard mantra when it comes to stocks,” MarketWatch reports. “It comes from the notion that the likely inability of lawmakers and the president to accomplish much means politicians won’t be able to do much harm nor to undo market-lifting measures already in place.”

The historical view

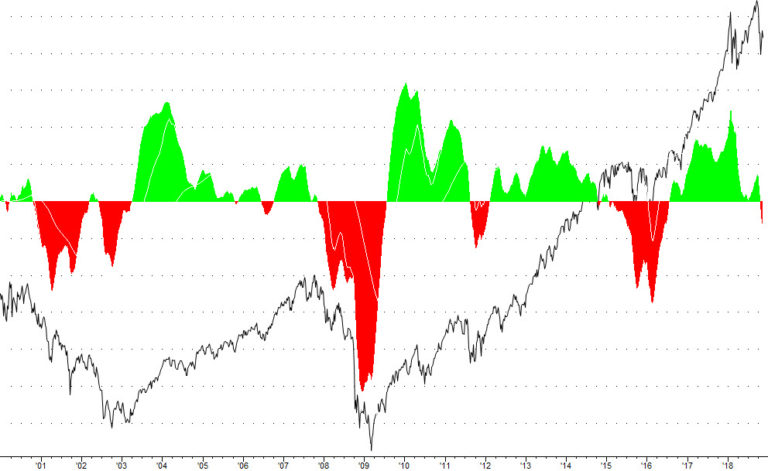

Markets are, generally speaking, indifferent to the results of midterm elections.

Historically, the October-through-September period surrounding a midterm has been the best 12 months for markets over the course of a presidential term. Still, the gains appear to be independent of partisan outcomes.

Little has changed since, so it should be no surprise that the S&P was up 1.5% at noon the day after the 2018 midterm. On Election Day itself, the index moved up 0.5% while the polls were open and nothing was certain.

So the real victor was the market economy and the institutions of a democratically elected federal republic. Those who feared that Donald Trump’s personal style is injurious to America’s body politic might yet be proved right, but it’s clear now that such injuries won’t be fatal. Those who believed the rhetoric about the Democratic agenda’s supposed hostility to economic prosperity and the rule of law can now take their arguments up with the entirety of the U.S. equity markets.

In short, as far as your investments are concerned, November 6 was just another day at the office. And we wouldn’t have it any other way.