Market Overview

Dividing the spoils

As this is being written, the House of Representatives has just concluded its fourth day of doing the two hours’ worth of work to name a new Speaker. Nothing else happens until that business is done. So, while Kevin McCarthy (R-Calif.) ultimately claimed that prize, it was beginning to look like it would be quite some time before there was a Ways and Means Committee to set tax policy, an Appropriations Committee to authorize spending and a Financial Services Committee to oversee regulation of capital markets. And yet, during the week that the 118th Congress was gaveled into order by a career Capitol Hill staffer, the Dow Jones Industrial Average went up almost 500 points. Go figure.

Considering the drubbing stocks took in 2022, maybe everything looks like good news now. Even so, the largest institutional investors are mostly signaling that 2023 will be better and that divided government is one of the reasons. While no one predicted this GOP-on-GOP floor fight, it has been a foregone conclusion that a Republican-controlled House and a right-leaning Supreme Court would clash with a Democrat-controlled Senate and White House.

“Divided government is a great outcome,” Guggenheim Partners Chief Investment Officer Scott Minerd told CNBC on Election Night 2022, noting that it would lead to a stasis in both taxation and spending. “That’s good from the standpoint of allowing the economy to cool off more and may limit the amount of [target interest rate] hiking the [Federal Reserve] has to do.”

“It is worth recalling that periods of divided government, in which one party controls the White House, while the other party controls one or both chambers of Congress, often limit legislative success,” concurs T. Rowe Price CIO Eric Veiel. “In this environment, corporations may find it easier to plan without having to anticipate changes in taxation.”

Veiel and his coauthors caution against making long-term investment decisions based on short-term political outcomes, and they are not as sanguine as Minerd regarding the impact of the 2022 election. They believe that this will prompt the Biden administration to rely on regulatory muscle to implement its agenda now that it faces more opposition in Congress. They further believe that Republicans, now in the majority in the House, will also be emboldened.

“The new Republican majority in the House could meaningfully change the dynamics of raising the debt ceiling — which is necessary for the U.S. Treasury to keep issuing debt to fund the government — by refusing to increase the ceiling without exacting spending‑related concessions from Democrats,” according to T. Rowe Price analyst Michael Pinkerton. “A group of 10 to 15 determined Republicans could drive brinkmanship related to the debt ceiling in 2023.”

He wrote that in November and we have all seen since then that there are more “determined” Republicans than needed for that result. If the debt ceiling isn’t raised, it won’t be the end of the world, but it would probably result in higher interest rates. The last time we did this dance, in 2011, Standard & Poor’s downgraded federal bonds’ rating. Back then, interest rates were so low the move turned out to have nominal impact. We can’t expect the same benign outcome in the current environment.

Strategic plays

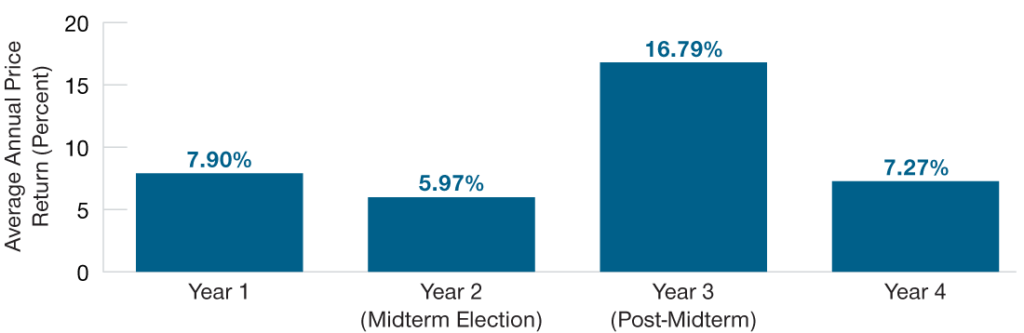

- Rowe Price’s assertion that individual elections don’t affect stock markets is well considered. While the article illustrates that post-midterm years are historically the strongest of a president’s term, it has little to do with who wins or loses control of Congress.

Average annual price return for each year in presidential term. Credit: T. Rowe Price

“Even when it comes to specific industries the impact you might expect doesn’t always hold true. Take the energy sector,” Northwest Mutual CIO Brent Schutte wrote for Forbes. “While you’d expect it to do well under the more energy-friendly Trump administration and not as well once President Biden took office, the opposite was true. This was largely due to external factors such as slowing demand—and that’s the point.”

Still, a TD Ameritrade blog post suggested that there are sectors that tend to benefit from gridlock, including Energy, Technology, Financials and Health Care. Author Dan Rosenberg also suggests that small-cap stocks tend to perform well.

Broadly speaking, then, divided government is a net positive for stocks. The difficult part becomes picking winners and losers, and that’s where experts disagree. It might be prudent to consult a trusted financial advisor who can help guide you through these next two – or more – years.