Market Overview

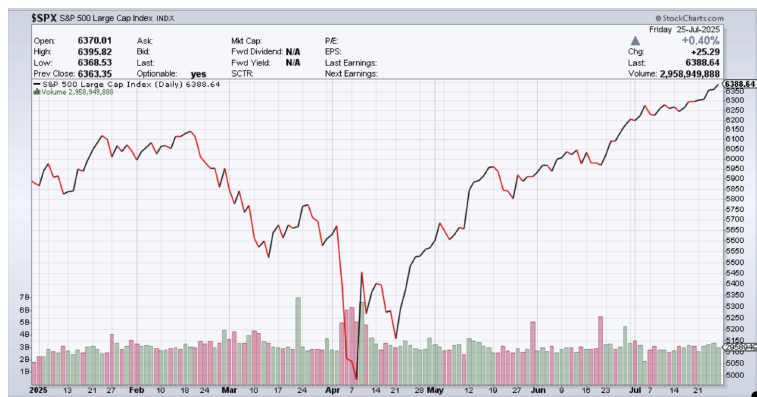

Since the last newsletter, all major US equity indices rose, with the S&P 500 rising 3.5%, the DJII up 2.5%, and the NASDAQ up 4.1%. Model portfolios remain well balanced, therefore there are NO CHANGES.

Equity & Macro Market Highlights

Equity markets have rallied sharply in July, with the S&P and Nasdaq setting fresh new highs. This resurgence reflects investor optimism on resilient U.S. economic fundamentals, lingering beliefs that President Trump’s tariff threats are negotiating tactics, and the speculative momentum around AI.

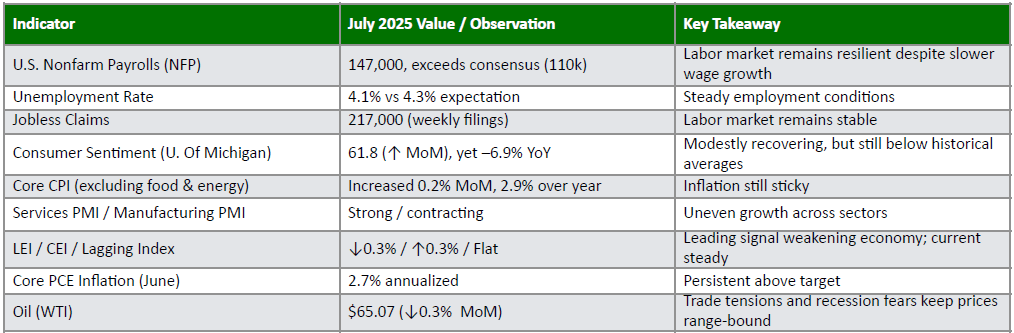

Underlying risks remain: Leading economic indicators—including consumer expectations and manufacturing orders—are weakening. The Conference Board’s Leading Economic Index (LEI) fell by 0.3% in June to 98.8, marking a cumulative 2.8% drop in 2025 so far.

Federal Reserve and Policy Developments

On June 17-18, the FOMC maintained the Federal Funds Rate at 4.25%-4.50%, unchanged since December 2024. In discussions ahead of the IMMINENT July 29-30 meeting, two Fed governors - Michelle Bowman and Christopher Waller - voiced support for a rate cut as early as July, breaking with Chair Powell’s cautious stance. Furthermore, President Trump has increased pressure on Powell, publicly pushing for immediate and deep rate cuts - up to 300 basis points. Powell remains firm on a data-dependent path forward.

Fixed Income Markets

Treasury yields have remained elevated amid geopolitical uncertainty and hawkish Fed policy. Nearly 80% of global fixed-income assets now yield over 4%, making longer-duration bonds, credit spreads, mortgage-backed securities, and emerging-market debt more appealing on yield grounds. See Fixed Income section for more information.

What’s Coming Next

- July 29–30 FOMC meeting: markets expect rates will be held steady; signals toward September rate cuts may emerge. Watch for potential dissents from Bowman and Waller.

- August data: job reports, inflation (PCE), manufacturing, and consumer indicators will be key to Fed decisions.

- Corporate earnings: sectors tied to capex and industrials will reflect the impact of trade and tariff policies.

What We’re Watching

Key Economic Indicators Summary Table

Index and Sector Analysis:

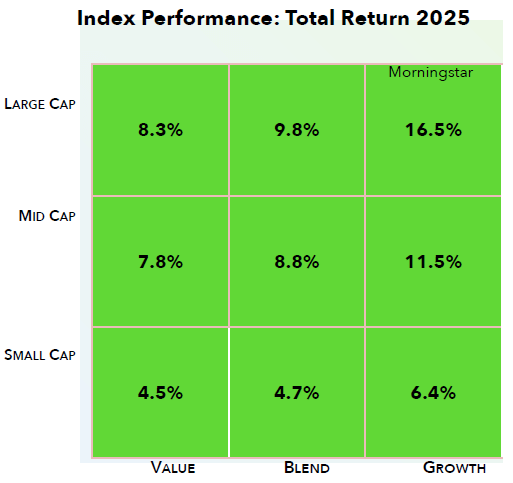

Indices: All index quadrants rose over the past month, with Mid-Cap and Small-Cap leading the way. Gains were broad based across growth and value styles, marking a shift from earlier large-cap leadership. Large-Cap Growth remains the top performer year-to-date at +16.5%, but its monthly gain of 3.9% lagged behind smaller-cap segments, signaling broader market participation.

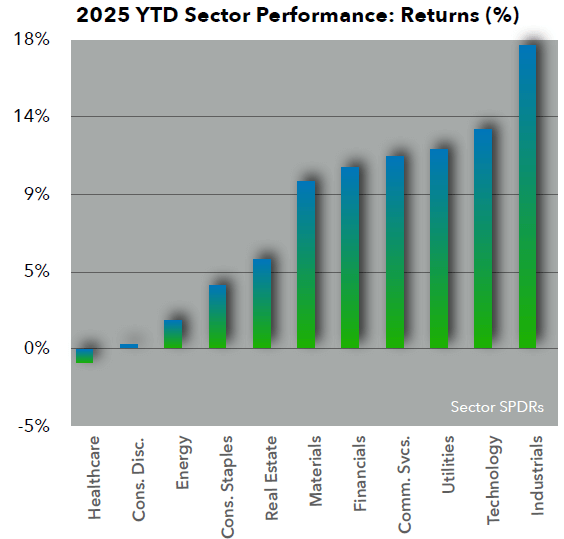

Sectors: With the S&P 500 posting another strong month, sector performance in July was broadly positive but more mixed than in June. Year to date, cyclical sectors are leading with Industrials (+17.6%) surging on strong earnings and increased capital spending and Technology (+12.7%) continuing to benefit from AI momentum and resilient demand. Communication Services (+11.2%) and Financials (+10.6%) also delivered robust gains, supported by upbeat corporate guidance and stable credit conditions. Despite a small rise in bond yields, Utilities (+11.7%) rallied sharply—an unusual move likely tied to investors seeking defensive yield exposure and some rotation into under owned sectors. Materials (+9.8%) and Real Estate (+5.2%) posted moderate gains, while Consumer Staples (+3.7%) and Energy (+1.7%) lagged the broader market. Consumer Discretionary (+0.2%) was essentially flat, and Health Care (-0.8%) was the only sector to post a loss, as investors shifted away from defensive positioning amid improving economic sentiment.

Fixed Income Market Update

Treasury yields moved higher across the curve in July as stronger-than-expected economic data and evolving Fed expectations weighed on bond prices. The 2-year yield rose from 3.75% to 3.94%, while the 10-year yield climbed from 4.29% to 4.39%. The yield curve remains positively sloped but flattened modestly from +54 to +45 basis points in July, reflecting reduced expectations for front-end easing even as long-term rates continue to price in modest growth and inflation risks.

- Economic Resilience Pressures Yields Upward: Robust consumer spending, firm industrial activity, and a still-strong labor market all signaled continued momentum in the U.S. economy. While inflation continued to moderate, the strength in growth led investors to reassess the timing and scale of potential Fed rate cuts.

- Fed Outlook Remains Cautious Ahead of July Meeting: The Federal Reserve is widely expected to hold rates steady at its upcoming July 29-30th meeting, with markets closely watching for any shift in tone. While recent economic data has shown a mix of cooling inflation and resilient growth, Fed officials have maintained a cautious, data-dependent stance. Investors remain divided over the likelihood of a rate cut in September, with expectations shifting as each new data point is released.

- Global Developments Add Noise but Not Direction: Volatility from Japan—where the Bank of Japan hinted at a possible rate hike—led to an unwind in global risk positions but had a limited effect on U.S. yields. Treasuries remained primarily influenced by domestic economic data and Fed guidance.

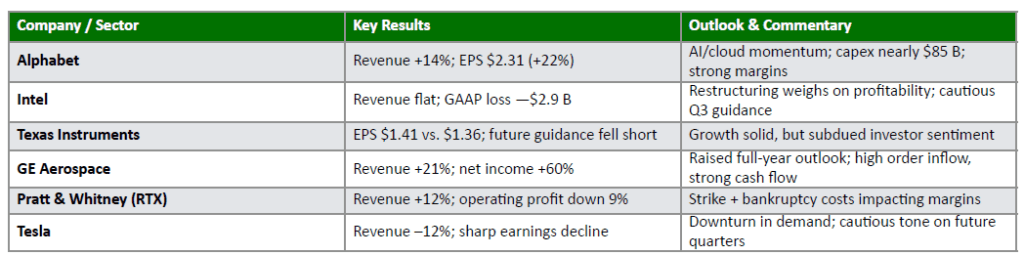

Corporate Earnings: Top Highlights by Company & Sector

- AI and cloud businesses are clearly pivot points driving standout growth in tech.

- Premature or aggressive restructuring (e.g., Intel) may temper near-term profitability and erode investor confidence.

- Company guidance appears more divergent: some firms like GE are optimistic, while others (Tesla, Intel) signal continued headwinds.

- Earnings season overall has delivered modest YoY growth, but results vary across sectors with mixed outcomes.

July 2025 was marked by resilience and exuberance—particularly in tech-led indexes, which hit fresh records amid easing trade tensions and upbeat earnings. Yet concerns around valuation excess, rising margin debt, and trade/policy uncertainty suggest that caution is warranted going into August and Q3 earnings season.