In January, U.S. stocks posted their biggest monthly losses in a year while bond prices traded higher and market volatility surged mostly due to concerns about the lack of global growth. February experienced almost the exact opposite with U.S. stock markets hitting new highs. The S&P 500 gained 5.49%, the Dow Jones Industrial Average (DJIA) jumped 5.64%, the world’s developed stock markets gained more than 6% (EFA), and emerging markets posted solid returns as well, climbing more than 4% (EEM).

January 2015 Recap

Deflate-gate and Mixed Signals

A “deflate-gate” of sorts hit Wall Street during the final week of January. On Tuesday, January 27th, the U.S. Census Bureau reported durable goods orders, core capital goods orders, and inventories; and overall, the information disappointed. Durable goods were down -3.4%. Capital goods orders were down -0.6%. Inventories increased +0.5%. The following day, the Federal Open Market Committee (the “Fed”) released a statement which pointed out that inflation is “anticipated to decline further in the near term,” and indicated they can be “patient” regarding a federal funds rate increase, but could move quickly if economic data improves sooner than anticipated. On Friday, January 30th, economic growth was reported at 2.6%, which was below estimates. On the same day, Eurostat reported the largest decline in consumer prices in the Eurozone since July of 2009. Equity markets across the globe responded by selling off.

2014 Market Recap

Happy New Year! A new year offers us all the opportunity to look back and make some sense of the year behind us.

In many ways, 2014 was a year dominated by headlines. Early in the year, a polar vortex swept across the U.S., and as a result, many expected slower economic growth. For the first time, a woman was appointed as chair of the Federal Reserve. Russia engaged in conflict with Ukraine and later annexed the region of Crimea. General Motors recalled millions of vehicles in order to fix faulty ignition switches. Home Depot got hacked. Ebola killed thousands in Africa. Ebola then found its way to the U.S., and markets panicked in response. Oil prices began a steep decline on Thanksgiving. Over the course of the year, U.S. unemployment went down to pre-recession levels. The Federal Reserve’s program, known as Quantitative Easing, officially came to a close. Sony then got hacked. North Korea’s internet went down. Somehow amidst it all, U.S. equity markets reached new highs on over 50 trading days throughout the year.

Mid-December Outlook

Since the beginning of December, U.S. stocks (S&P 500) are up more than 3%.

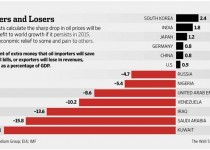

The U.S. bond market is right at breakeven for the month and has shown only a fraction of the volatility. Foreign markets are down much more so far in December. Foreign developed markets are down more than 4.5%, and emerging market stocks are down more than 7%. Altogether, the global stock market is down more than 4% for December. As you can probably imagine, market watchers have been fixated on what’s going on in the world’s oil markets. Crude oil is down more than 15% so far this month, and is down almost 45% since June.

October 2014 Market Recap

On October 31st, millions of children across the U.S. donned costumes and went door to door filling their baskets with candy. Thousands of costume parties were thrown for the adults that enjoy Halloween and many people parked themselves in front of a screen to watch scary movies. There is plenty of research on the psychology of horror films allowing researchers to clearly identify that there are both people who enjoy these movies and those who will not subject themselves to scary movies for any reason. Regardless of which group you fall into for Hollywood horror movies, we were all forced to watch market volatility increase in the month of October as various economic “antagonists” came to the forefront.

October Mid-Month Thoughts on the Market

Key Points

U.S. equity markets endured their third consecutive week of losses as volatility climbed. The S&P 500 Index was down sharply enduring its largest weekly decline since May 2012. The sell-off can be blamed on a number of factors, with concerns over global growth coming in first on that list. Ongoing angst over the end of the Federal Reserve’s quantitative easing program and trepidation in advance of third-quarter earnings reports can also take their share of the blame.

Sentiment towards airline stocks lowest since 2013.

Have some airline stocks peaked? $AAL $DAL $UAL $FDX http://goo.gl/cYNj1E

US Ecomomy and European Central Bank (ECB) announcements

Quick Recap Domestic stocks have experienced a little more volatility than what has been usual this year; however U.S. equities continue their winning ways. Although the August employment data were somewhat disappointing, investors were encouraged by strong manufacturing trends. Events outside of the U.S. also contributed to the positive tone. The European Central Bank (ECB)

March 2015 Recap

March Madness is in full swing with over 60 games having already been played.People all over the world fill out their brackets in hopes that they can predict the future, including the surprise upsets that turn an “also ran” bracket into a money winner. Those who filled out their brackets by working from the Championship game backwards and opting for favorites like Kentucky, Wisconsin, Duke, and Villanova are feeling rather confident right now. In the world of finance, investors are attempting to do the same thing when it comes to the Federal Reserve Bank’s interest policy. The favorites in this game are the consensus opinions regarding when and how the Fed Funds Rate is going to increase, and that has been June and is now starting to get pushed back to September. Instead of analyzing coaches, rosters and game stats, investors are studying Fed statements, inflation data, dollar strength, unemployment figures and economic measures such as GDP.